The Growth Commission, a non-partisan group of thirteen international economists dedicated to supporting growth as measured by GDP per capita has just released a new policy paper, warning that failure to take urgent action to reverse steep economic structural decline across Europe will result in marginalisation on the global stage and declining living standards across the continent.

The paper, Raising the Bar: How to Transform Europe into a High GDP Growth Continent, sets out a series of stark facts that demonstrates the scale of the decline facing Europe:

- Over the last 20 years EU growth has barely averaged 1% per annum

- In a generation the EU share of global GDP (on a purchasing power parity basis) has decreased from almost one quarter to one seventh

- Average growth in Australia, Canada, the U.S. and the OECD has been more than double the European level

- If the EU had grown at the same rate as the U.S. since 2005, the European economy would be $3 trillion greater today – equivalent to $8,500 per head in lost opportunity

OUT TODAY!

Our new paper by Ewen Stewart sets out:

📉The scale of economic decline facing Europe

🌍Which nations are bucking the trend and why

📈How to make Europe grow again

Read it for yourself 👇https://t.co/wE3PhP6KMj pic.twitter.com/EElkjKcUpP— The Growth Commission (@TheGrowthComm) September 11, 2025

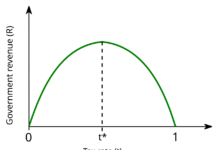

The paper identifies the average size of the state in European nations as the principal reason for lethargic growth, as evidenced by the expanse of the public sector, the size of the tax burden and onerous regulatory frameworks.

In Europe, the state generally accounts for between 44% and 55% of GDP, some ten percentage points higher than North America and some twenty percentage points higher than Asia. The paper finds a clear inverse correlation between size of the state and GDP growth. From a control group of 21 major nations, a 5% decline in state size adds c.1% growth per annum.

"Nieuwe belastingen om het begrotingstekort te dichten". Dweilen met de kraan open zolang de echte olifant in de kamer genegeerd blijft: de astronomische uitgavenberg.

België gaat met 56% overheidsbeslag naar de hoogste staatsuitgaven van alle industrielanden. Ter vergelijking:… pic.twitter.com/lCl1B4mnbI

— Durf (@Project_Durf) September 15, 2025

Further causes of the continent’s growth problem are identified as its relatively high energy prices, rigid employment regulations and a general lack of corporate dynamism and entrepreneurship.

Ewen Stewart, Growth Commissioner and author of Raising the Bar: How to Transform Europe into a High GDP Growth Continent, stressed:

“Europe is in steep structural economic decline. The fact is that Europe is the global statist continent. No other region has a public sector, tax or regulatory framework remotely as complex and onerous as the EU’s. Meanwhile, the near total dominance of the U.S. and, to an extent, China in new technology is striking: of the 100 largest global technology companies by market capitalisation, only four are European. The continent must either rediscover her dynamism or face increasing global marginalisation.”

If Europe is to grow again, it needs to learn lessons from the few European nations which are successfully pursuing a pro-growth agenda, namely the Visegrad Group, Slovenia and the Baltic states, explains Ewen Stewart 👇https://t.co/wE3PhP6cWL pic.twitter.com/chc9uY8MCS

— The Growth Commission (@TheGrowthComm) September 11, 2025

The Growth Commission further notes that “the good news is that there are some bright spots in Eastern Europe which provide evidence of the kind of approach that will boost economic growth – namely the Visegrad Group (Poland, the Czech Republic, Slovakia and Hungary), Slovenia and the Baltic states (Estonia, Latvia and Lithuania).

These nations have lowered taxes, reduced the size of the state and generally been fiscally prudent with sustainable debt/GDP levels – and their growth rates reflect these wise decisions.”

Shanker Singham, Chairman of The Growth Commission, commented:

“The private sector is a far more efficient allocator of capital than the state. By recycling spending control into tax cuts, a virtuous circle can be created rather than the current doom loop of despair and decline. Coupled with a focus on reducing energy prices, liberalising labour markets and focusing on encouraging gainful employment over welfarist strategies, Europe could regain its mojo – and quite quickly.”

The paper makes a series of policy recommendations in order to reverse the decline:

- Free up energy markets and accept that the rest of the world has little de facto interest in Net Zero policies. Europe needs to rediscover market-based power solutions which in time will deliver diverse lower cost supply. This means that Europe needs to harness its carbons assets. Europe’s industrial base cannot compete where its base energy costs are between two and four times those of the U.S., let alone the cost base of India and China.

- Start to deregulate labour markets, limiting growth in minimum wages and reducing impediments on labour flexibility. Such a strategy would increase employment formation and opportunity, thereby aiding dynamism.

- Reach a comprehensive trade deal with the U.S.in goods and services, which would create a win-win trade scenario. And in seeking other deals, such as with India, the EU needs to move away from seeking to push harmonisation according to EU standards on the rest of the world and move into a world of regulatory competition and inter-operability on the basis of mutual recognition and equivalence.

- Focus on empowering the population through greater labour flexibilityrather than importing cheap foreign labour.

- Greatly increase new company formation. Encouraging greater start-up capital pools and tax incentives, coupled with greater labour market flexibility, should start this process.

- Become tax competitive globally, both in terms of absolute rates and tax design and adopt tax provisions that reduce tax barriers to investment and capital formation. These should include moving capital consumption (depreciation) allowances in the direction of full expensing for corporate and non-corporate business investment; reducing the corporate tax rate and reducing the double taxation of corporate income by integrating the corporate and individual tax systems; refocusing property taxes on land rather than improvements such as buildings and infrastructure; and eliminating death taxes.

- Re-examine every new regulationintroduced over the last ten years with a presumption to repeal unless there is an overwhelming reason not to.

- Decentraliseby delegating power back to national capitals and community levels, creating competition of ideas, regulation and performance as a means of driving growth.

- Examine much more closely the opportunity cost of the large-state, social welfare model. The world has changed and with it the social model growth discount needs to be reversed.

The paper concludes by proposing that the EU should adopt a ten-year plan to reduce the size of the public sector by 5% relative to GDP by 2035 and a further 5% by 2045, at which point typically the state would still account for around 35% of GDP – a high figure by global standards, but much closer to the OECD average.

Interesting. Two of the most reforming governments in the last forty years or so in the rich world have been the Labour Governments of Douglas and Keating in NZ and Aus respectively. The key is ensuring competition on the merits is the organizing principle not state direction. https://t.co/LerGpi8CvR

— Shanker Singham (@ShankerASingham) September 15, 2025